The Greatest Guide To Mortgage Broker In Scarborough

Wiki Article

9 Easy Facts About Mortgage Broker Scarborough Described

Table of ContentsA Biased View of Mortgage Broker In ScarboroughExamine This Report on Mortgage Broker In ScarboroughThe 8-Minute Rule for Mortgage Broker In ScarboroughNot known Details About Scarborough Mortgage Broker The 2-Minute Rule for Mortgage BrokerSee This Report about Mortgage Broker In Scarborough

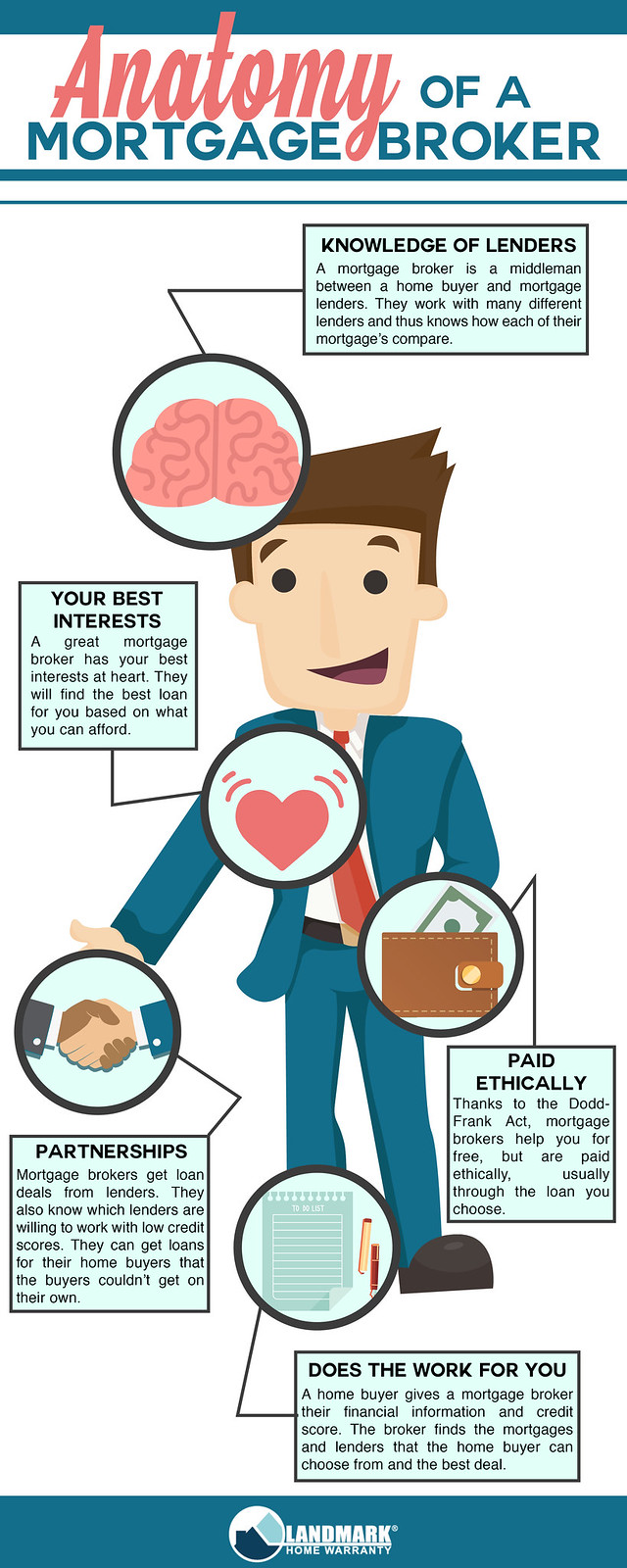

What Is a Home loan Broker? The home mortgage broker will certainly work with both events to obtain the specific authorized for the lending.A home loan broker normally functions with several various loan providers and also can supply a selection of funding options to the consumer they work with. What Does a Home loan Broker Do? A home loan broker aims to complete realty transactions as a third-party intermediary in between a consumer as well as a lender. The broker will gather info from the individual as well as most likely to several lenders in order to discover the finest prospective financing for their client.

All-time Low Line: Do I Required A Mortgage Broker? Collaborating with a home loan broker can save the debtor time as well as effort throughout the application procedure, and also potentially a great deal of cash over the life of the car loan. Furthermore, some lenders function exclusively with mortgage brokers, meaning that borrowers would have access to loans that would certainly otherwise not be available to them.

Not known Factual Statements About Mortgage Broker Scarborough

It's crucial to check out all the costs, both those you may have to pay the broker, along with any kind of charges the broker can aid you prevent, when evaluating the choice to work with a home loan broker.

What is a mortgage broker? A home loan broker acts as an intermediary in between you and also prospective loan providers. Home loan brokers have stables of lenders they work with, which can make your life simpler.

The 6-Second Trick For Mortgage Broker

Just how does a home mortgage broker obtain paid? Home loan brokers are frequently paid by loan providers, sometimes by debtors, however, by regulation, never ever both. That regulation the Dodd-Frank Act Forbids home mortgage brokers from charging concealed costs or basing their payment on a customer's interest rate. You can likewise select to pay the mortgage broker on your own.

Home mortgage brokers might be able to offer consumers accessibility to a wide selection of car loan kinds. You can save time by using a home loan broker; it can take hours to use for preapproval with various loan providers, after that there's the back-and-forth communication involved in financing the funding and making certain the purchase remains on track.

What Does Mortgage Broker Near Me Mean?

When picking any kind of loan provider whether with a broker or straight you'll want to pay attention to lending institution charges." After that, take the Financing Estimate you obtain from each lending institution, position them side by side and contrast your passion rate as well as all of the charges and also shutting prices.5. mortgage broker near me. Exactly how do I pick a home mortgage broker? The most effective way is to ask friends as well as loved ones for referrals, but ensure they have in fact used the broker as well as aren't simply going down the name of a former university flatmate or a far-off associate. Discover all you can concerning the broker's services, communication style, degree of expertise and approach to clients.

Ask your representative for the names of a couple of brokers that they have actually collaborated with as well as depend on. Some realty firms use an internal home loan broker as component of their collection of services, yet you're not obligated to opt for that business or individual. Finding the right home mortgage broker is simply like picking the most effective home mortgage loan provider: It's smart to speak with at the very least 3 people to learn what services they offer, just how much experience they have and also exactly how they can aid streamline the process.

The 4-Minute Rule for Mortgage Broker Scarborough

Frequently asked concerns, What does a home mortgage broker do? A home loan broker locates lenders with finances, rates, and terms to fit your demands.

Competitors and also home prices will influence just how much mortgage brokers make money. What's the distinction in between a home loan broker and a lending policeman? Home loan brokers will certainly function with several loan providers to find the most effective lending for your situation. Financing police officers benefit one lender. Exactly how do I find a mortgage broker? The most effective means to locate a home loan broker is with referrals from family, pals as well as your real estate representative.

Investing in a brand-new house is just one of the most complicated occasions in an individual's life. Feature differ considerably in terms of style, amenities, school district and also, certainly, the always vital "place, area, location." The home mortgage application process is a challenging aspect of the mortgage broker homebuying procedure, specifically for those without previous experience - mortgage broker.

Mortgage Broker for Beginners

Report this wiki page